Page 184 - flipbook-ubp-IR

P. 184

INTRODUCTION ABOUT US MANAGEMENT APPROACH

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2022

11.

NON-CURRENT FINANCIAL ASSETS (CONTINUED)

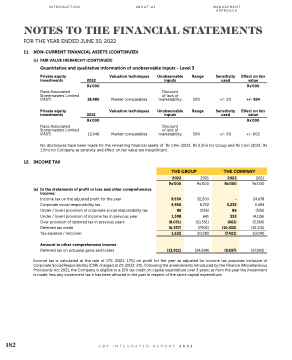

(c) FAIR VALUE HIERARCHY (CONTINUED)

Quantitative and qualitative information of unobservable inputs - Level 3

Private equity investments

Flacq Associated Stonemasters Limited (FAST)

Private equity investments

Flacq Associated Stonemasters Limited (FAST)

2022 Rs’000

18,480

2021 Rs’000

12,046

Valuation techniques

Market comparables

Valuation techniques

Market comparables

Unobservable inputs

Discount

of lack of marketability

Unobservable inputs

Discount

of lack of marketability

Range

50%

Range

50%

Sensitivity used

+/- 5%

Sensitivity used

+/- 5%

Effect on fair value

Rs’000

+/- 924

Effect on fair value

Rs’000

+/- 602

12.

INCOME TAX

(a) In the statements of profit or loss and other comprehensive income:

Income tax on the adjusted profit for the year

Corporate social responsibility tax

Under / (over) provision of corporate social responsibility tax Under / (over) provision of income tax in previous year

Over provision of deferred tax in previous years

Deferred tax credit

Tax expense / (income)

Amount in other comprehensive income

Deferred tax on actuarial gains and losses

No disclosures have been made for the remaining financial assets of Rs 1.9m (2021: Rs 2.3m) for Group and Rs 1.5m (2021: Rs 1.5m) for Company as sensivity and effect on fair value are insignificant.

THE GROUP

2022

(8,031)

(6,537)

1,622

(13,911)

2021

20,583

(34,598)

THE COMPANY

2022

Rs’000

9,550

4,956

1,598

86

Rs’000

32,200 6,732 (536) 641 (10,551) (7,903)

Rs’000

3,233

(10,432)

86

353

(661)

-

(7,421)

(9,657)

2021 Rs’000

24,678 5,494 (536) (4,126) (5,360) (10,110) 10,040

(27,243)

182

UBP INTEGRATED REPORT 2022

Income tax is calculated at the rate of 17% (2021: 17%) on profit for the year as adjusted for income tax purposes inclusive of Corporate Social Responsibility (CSR) charged at 2% (2021: 2%). Following the amendments introduced by the Finance (Miscellaneous Provisions) Act 2021, the Company is eligible to a 15% tax credit on capital expenditure over 3 years, as from the year the investment is made, less any investment tax it has been allowed in the past in respect of the same capital expenditure.