Page 186 - flipbook-ubp-IR

P. 186

INTRODUCTION ABOUT US MANAGEMENT APPROACH

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2022

12.

INCOME TAX (CONTINUED)

(e)

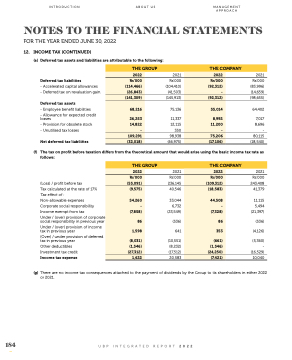

Deferred tax assets and liabilities are attributable to the following:

Deferred tax liabilities

- Accelerated capital allowances - Deferred tax on revaluation gain

Deferred tax assets

- Employee benefit liabilities

- Allowance for expected credit losses

- Provision for obsolete stock - Unutilised tax losses

Net deferred tax liabilities

THE GROUP

2022

(114,466)

(26,843)

26,253

14,822

109,291

-

2021

Rs’000 (104,410) (41,503)

75,136

11,337 12,115 350

(46,975)

THE COMPANY

2022

Rs’000

Rs’000

(92,312)

55,014

8,992

11,200

75,206

-

(141,309)

(145,913)

68,216

(92,312)

-

98,938

(32,018)

(17,106)

2021 Rs’000 (83,996) (14,659) (98,655)

64,402

7,017 8,696 - 80,115 (18,540)

(f)

The tax on profit before taxation differs from the theoretical amount that would arise using the basic income tax rate as follows:

THE GROUP

2022

(55,091)

54,260

(7,858)

1,598

(8,031)

(1,546)

(27,312)

86

-

2021

40,546

33,044 6,732 (23,549)

(536)

641

(10,551) (8,232) (17,512)

THE COMPANY

2022

Rs’000

Rs’000 236,145

Rs’000

(109,312)

(9,575)

(18,583)

44,508

(7,328)

(661)

(1,546)

86

353

-

1,622

20,583

(24,250)

(7,421)

(Loss) / profit before tax

Tax calculated at the rate of 17%

Tax effect of :

Non-allowable expenses

Corporate social responsibility

Income exempt from tax

Under / (over) provision of corporate social responsibility in previous year

Under / (over) provision of income tax in previous year

(Over) / under provision of deferred tax in previous year

Other deductibles Investment tax credit Income tax expense

2021 Rs’000 243,408 41,379

11,115 5,494 (21,397)

(536) (4,126)

(5,360) - (16,529) 10,040

184

UBP INTEGRATED REPORT 2022

(g)

There are no income tax consequences attached to the payment of dividends by the Group to its shareholders in either 2022 or 2021.