Page 188 - flipbook-ubp-IR

P. 188

INTRODUCTION ABOUT US MANAGEMENT APPROACH

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2022

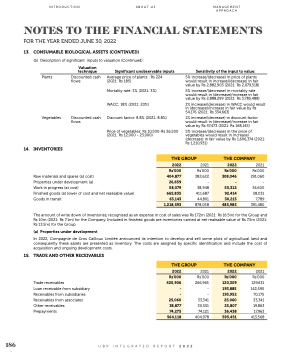

13. CONSUMABLE BIOLOGICAL ASSETS (CONTINUED)

(b) Description of significant inputs to valuation (Continued):

Plants

Vegetables

14. INVENTORIES

Valuation technique

Discounted cash flows

Discounted cash flows

Significant unobservable inputs

Average price of plants : Rs 224 (2021: Rs 185)

Mortality rate: 3% (2021: 3%)

WACC: 18% (2021: 20%)

Discount factor: 8.8% (2021: 8.8%)

Price of vegetables: Rs 10,500-Rs 26,500 (2021: Rs 12,000 - 23,000)

Sensitivity of the input to value:

5% increase/(decrease) in price of plants would result in increase/(decrease) in fair value by Rs 2,882,903 (2021: Rs 2,079,518)

5% increase/(decrease) in mortality rate would result in (decrease)/increase in fair value by Rs 2,888,299 (2021: Rs 3,785,488)

1% increase/(decrease) in WACC would result in (decrease)/increase in fair value by Rs 54,176 (2021: Rs 334,663)

1% increase/(decrease) in discount factor would result in (decrease)/increase in fair value by Rs 57,473 (2021: Rs 168,145)

5% increase/(decrease) in the price of vegetables would result in increase/ (decrease) in fair value by Rs 1,606,374 (2021: Rs 1,210,931)

2021 Rs’000 291,060 - 34,600 58,031 7,789 391,480

THE GROUP

2022

Rs’000

404,877

26,659

58,079

665,835

63,143

2021

Rs’000 382,622 - 38,948 411,687 44,801

THE COMPANY

2022

Rs’000

308,046

55,312

92,414

30,213

-

1,218,593

878,058

485,985

Raw materials and spares (at cost)

Properties under development (a)

Work in progress (at cost)

Finished goods (at lower of cost and net realisable value) Goods in transit

15.

TRADE AND OTHER RECEIVABLES

Trade receivables

Loan receivable from subsidiary Receivables from subsidiaries Receivables from associates Other receivables

Prepayments

The amount of write down of inventories, recognised as an expense in cost of sales was Rs 17.2m (2021: Rs 16.5m) for the Group and Rs 10m (2021: Rs 7.1m) for the Company. Included in finished goods are inventories carried at net realisable value of Rs 7.5m (2021: Rs 13.5m) for the Group.

(a) Properties under development

In 2022, Compagnie de Gros Cailloux Limitée announced its intention to develop and sell some plots of agricultural land and consequently these assets are presented as inventory. The costs are assigned by specific identification and include the cost of acquisition and ongoing development costs.

THE GROUP

2022

25,060

38,877

74,275

2021

THE COMPANY

2022

Rs’000

425,906

-

-

Rs’000 266,965 - - 33,341 30,551 74,121

Rs’000

120,309

193,885

193,952

25,060

25,807

36,438

564,118

404,978

595,451

2021 Rs’000 129,631 142,595 70,175 33,341 19,863 17,963 413,568

186

UBP INTEGRATED REPORT 2022