Page 189 - flipbook-ubp-IR

P. 189

OUR CORPORATE PERFORMANCE GOVERNANCE

Trade receivables are non-interest bearing and are generally on 30 days’ terms.

Other receivables comprise of advances made to suppliers, amounts due from related entities amongst others.

Other receivables are non-interest bearing and having an average term of 6 months.

For terms and conditions relating to receivables from related parties, refer to note 29.

The fair values of the trade and other receivables approximate their carrying amounts.

As at June 30, 2022, the Group’s and the Company’s trade receivables amounting to Rs 159.4m (2021: Rs 67.9m) and Rs 42.2m (2021: Rs 31.9m) were impaired and provided for.

See note 4(b) on credit risk of trade receivables, which explains how the Group manages and measures credit quality of trade receivables that are neither past due nor impaired.

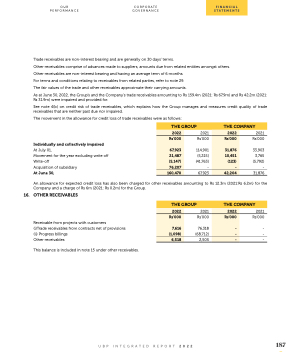

The movement in the allowance for credit loss of trade receivables were as follows:

Individually and collectively impaired

At July 01,

Movement for the year excluding write off Write-off

Acquisition of subsidiary

At June 30,

2021 Rs’000

33,903 3,765 (5,792) - 31,876

THE GROUP

2022

(5,147)

76,207

160,470

2021

THE COMPANY

2022

Rs’000

67,923

21,487

Rs’000

114,901 (5,215) (41,763) -

Rs’000

31,876

10,451

(123)

42,204

-

67,923

An allowance for expected credit loss has also been charged for other receivables amounting to Rs 12.3m (2021:Rs 6.2m) for the Company and a charge of Rs 6m (2021: Rs 0.2m) for the Group.

16. OTHER RECEIVABLES

Receivable from projects with customers

(i)Trade receivables from contracts net of provisions (ii) Progress billings

Other receivables

This balance is included in note 15 under other receivables.

2021 Rs’000

- - -

2022

2021

THE COMPANY

2022

UBP INTEGRATED REPORT 2022

187

THE GROUP

Rs’000

7,616

(1,098)

Rs’000

76,318 (68,712)

Rs’000

-

-

6,518

2,505

-

FINANCIAL STATEMENTS