Page 191 - flipbook-ubp-IR

P. 191

OUR CORPORATE PERFORMANCE GOVERNANCE

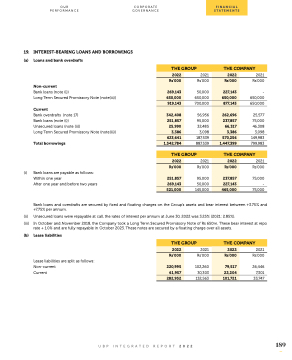

19. INTEREST-BEARING LOANS AND BORROWINGS (a) Loans and bank overdrafts

Non-current

Bank loans (note (i))

Long Term Secured Promissory Note (note(iii))

Current

Bank overdrafts (note 17)

Bank loans (note (i))

Unsecured loans (note (ii))

Long Term Secured Promissory Note (note(iii))

Total borrowings

(i) Bank loans are payable as follows: Within one year

After one year and before two years

2021 Rs’000

- 650,000 650,000

25,577 75,000 46,308

3,098 149,983 799,983

2021 Rs’000

75,000 - 75,000

THE GROUP

2022

269,143

650,000

251,857

25,990

3,386

623,641

2021

Rs’000

50,000 650,000

56,956 95,000 32,485 3,098

887,539

THE COMPANY

2022

Rs’000

Rs’000

227,143

650,000

919,143

700,000

342,408

877,143

262,696

237,857

66,317

3,386

187,539

570,256

1,542,784

1,447,399

THE GROUP

2022

2021

THE COMPANY

2022

Rs’000

251,857

269,143

Rs’000

95,000 50,000

Rs’000

237,857

Bank loans and overdrafts are secured by fixed and floating charges on the Group’s assets and bear interest between +3.75% and +7.75% per annum.

(ii) Unsecured loans were repayable at call, the rates of interest per annum at June 30, 2022 was 3.25% (2021: 2.85%).

(iii) In October and November 2018, the Company took a Long Term Secured Promissory Note of Rs 650m. These bear interest at repo rate + 1.0% and are fully repayable in October 2023. These notes are secured by a floating charge over all assets.

(b) Lease liabilities

Lease liabilities are split as follows: Non-current

Current

2021 Rs’000

26,446 7,301 33,747

UBP INTEGRATED REPORT 2022

189

521,000

227,143

145,000

2022

2021

465,000

THE GROUP

THE COMPANY

2022

Rs’000

220,995

61,957

Rs’000

102,260 30,303

Rs’000

79,517

22,204

282,952

132,563

101,721

FINANCIAL STATEMENTS