Page 192 - flipbook-ubp-IR

P. 192

INTRODUCTION ABOUT US MANAGEMENT APPROACH

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2022

19.

(b) (i)

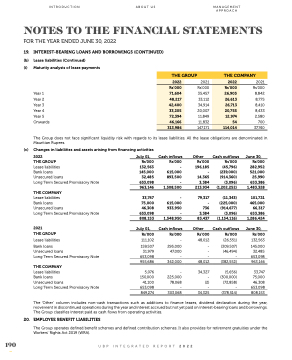

INTEREST-BEARING LOANS AND BORROWINGS (CONTINUED)

Lease liabilities (Continued) Maturity analysis of lease payments

Year 1 Year 2 Year 3 Year 4 Year 5 Onwards

THE GROUP

2022

33,205

72,394

46,166

2021

THE COMPANY

2022

Rs’000

71,604

48,217

42,400

Rs’000 35,457 33,112 34,914 20,007 11,849 11,832

Rs’000

26,905

26,613

26,713

20,755

12,974

54

313,986

147,171

114,014

2021 Rs’000 8,842 8,775 8,410 8,433 2,580 700 37,740

(c)

Changes in liabilities and assets arising from financing activities

The Group does not face significant liquidity risk with regards to its lease liabilities. All the lease obligations are denominated in Mauritian Rupees.

2022

THE GROUP

Lease liabilities

Bank loans

Unsecured loans

Long Term Secured Promissory Note

THE COMPANY

Lease liabilities

Bank loans

Unsecured loans

Long Term Secured Promissory Note

2021

THE GROUP

Lease liabilities

Bank loans

Unsecured loans

Long Term Secured Promissory Note

THE COMPANY

Lease liabilities

Bank loans

Unsecured loans

Long Term Secured Promissory Note

July 01,

Rs’000 132,563 145,000

32,485 653,098

963,146

33,747 75,000 46,308

653,098

808,153

July 01,

Rs’000

111,102

159,507 31,979 653,098

955,686

5,076 150,000 41,100 653,098

849,274

Cash inflows

Rs’000 - 615,000 893,500 -

1,508,500

- 615,000 933,950 -

1,548,950

Cash inflows

Rs’000

-

295,000 47,000 -

342,000

- 225,000 78,068 -

303,068

Other

Rs’000 196,185 - 14,365 3,384

213,934

79,317 - 736 3,384

83,437

Other

Rs’000

48,012

- - -

48,012

34,327 - (2) -

34,325

Cash outflows

Rs’000 (45,796) (239,000) (914,360) (3,096)

(1,202,252)

(11,343) (225,000) (914,677) (3,096)

(1,154,116)

Cash outflows

Rs’000

(26,551)

(309,507) (46,494) -

(382,552)

(5,656) (300,000) (72,858) -

(378,514)

June 30,

Rs’000 282,952 521,000

25,990 653,386

1,483,328

101,721 465,000 66,317 653,386

1,286,424

June 30,

Rs’000

132,563

145,000 32,485 653,098

963,146

33,747 75,000 46,308

653,098

808,153

190

UBP INTEGRATED REPORT 2022

20.

The ‘Other’ column includes non-cash transactions such as additions to finance leases, dividend declaration during the year, movement in discontinued operations during the year and interest accrued but not yet paid on interest-bearing loans and borrowings. The Group classifies interest paid as cash flows from operating activities.

EMPLOYEE BENEFIT LIABILITIES

The Group operates defined benefit schemes and defined contribution schemes. It also provides for retirement gratuities under the Workers’ Rights Act 2019 (WRA).