Page 182 - flipbook-ubp-IR

P. 182

INTRODUCTION ABOUT US MANAGEMENT APPROACH

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2022

11.

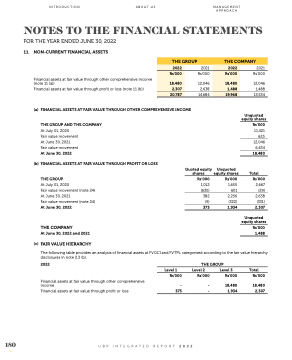

NON-CURRENT FINANCIAL ASSETS

Financial assets at fair value through other comprehensive income (note 11 (a))

Financial assets at fair value through profit or loss (note 11 (b))

(a) FINANCIAL ASSETS AT FAIR VALUE THROUGH OTHER COMPREHENSIVE INCOME

THE GROUP AND THE COMPANY

At July 01, 2020

Fair value movement At June 30, 2021

Fair value movement At June 30, 2022

(b) FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS THE GROUP

At July 01, 2020

Fair value movement (note 24) At June 30, 2021

Fair value movement (note 24) At June 30, 2022

THE COMPANY

At June 30, 2022 and 2021

(c) FAIR VALUE HIERARCHY

Quoted equity shares

Rs’000

1,012 (630)

382 (9)

373

Unquoted equity shares

Rs’000

1,655 601

2,256 (322)

1,934

2021 Rs’000

12,046 1,488 13,534

Unquoted equity shares

Rs’000

11,421 625 12,046 6,434 18,480

Total

Rs’000

2,667 (29)

2,638 (331)

2,307

Unquoted equity shares

Rs’000 1,488

The following table provides an analysis of financial assets at FVOCI and FVTPL categorised according to the fair value hierarchy disclosures in note 2.3 (b).

2022

Financial assets at fair value through other comprehensive income

Financial assets at fair value through profit or loss

THE GROUP

Level 1 Level 2 Level 3

Rs’000 Rs’000 Rs’000

- - 18,480 373 - 1,934

Total

Rs’000

18,480 2,307

180

UBP INTEGRATED REPORT 2022

THE GROUP

2022

2021

THE COMPANY

2022

Rs’000

18,480

2,307

Rs’000

12,046 2,638

Rs’000

18,480

1,488

20,787

14,684

19,968