Page 183 - flipbook-ubp-IR

P. 183

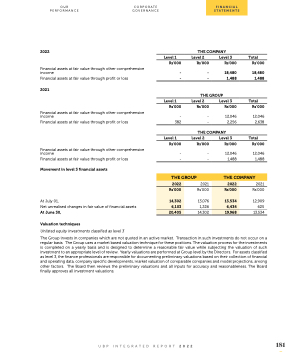

2022

THE COMPANY

Level 2 Level 3

Rs’000 Rs’000

- 18,480 - 1,488

THE GROUP

Level 2 Level 3

Rs’000 Rs’000

- 12,046

OUR CORPORATE PERFORMANCE GOVERNANCE

Rs’000 income -

Financial assets at fair value through other comprehensive Financial assets at fair value through profit or loss

2021

-

Financial assets at fair value through other comprehensive

income -

Financial assets at fair value through profit or loss 382 -

THE COMPANY

2,256

Level 1

Total

Rs’000

18,480 1,488

Total

Rs’000

12,046 2,638

Total

Rs’000

12,046 1,488

2021 Rs’000

12,909 625 13,534

Level 1

Rs’000

Level 1 Level 2

Rs’000 Rs’000

Financial assets at fair value through other comprehensive

income - -

Level 3

Rs’000

12,046 1,488

Financial assets at fair value through profit or loss

Movement in level 3 financial assets

At July 01,

Net unrealised changes in fair value of financial assets At June 30,

Valuation techniques

Unlisted equity investments classified as level 3

- -

THE GROUP

2022

2021

2022

The Group invests in companies which are not quoted in an active market. Transaction in such investments do not occur on a regular basis. The Group uses a market based valuation technique for these positions. The valuation process for the investments is completed on a yearly basis and is designed to determine a reasonable fair value while subjecting the valuation of such investment to an appropriate level of review. Yearly valuations are performed at Group level by the Directors. For assets classified as level 3, the finance professionals are responsible for documenting preliminary valuations based on their collection of financial and operating data, company specific developments, market valuation of comparable companies and model projections, among other factors. The Board then reviews the preliminary valuations and all inputs for accuracy and reasonableness. The Board finally approves all investment valuations.

UBP INTEGRATED REPORT 2022 181

THE COMPANY

Rs’000

14,302

6,103

Rs’000

13,076 1,226

Rs’000

13,534

6,434

20,405

14,302

19,968

FINANCIAL STATEMENTS