Page 204 - flipbook-ubp-IR

P. 204

INTRODUCTION ABOUT US MANAGEMENT APPROACH

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2022

33.

34.

35.

HOLDING COMPANY

The Directors regard IBL Ltd incorporated in Mauritius as the holding company. Its registered address is 4th Floor, IBL House, Caudan Waterfront, Port Louis.

EVENTS AFTER REPORTING DATE

In reference to the communiqué dated June 23, 2022 concerning the acquisition of a group of companies operating in a similar line of business of the Company in Reunion Island, a Share Purchase Agreement (SPA) was signed on July 07, 2022 . The transaction is subject to the satisfactory completion of conditions precedent, the obtention of all regulatory, corporate and any other approvals required by the parties. The transaction will enable the UBP Group to expand its principal activities within the Indian Ocean.

The Company has acquired land and buildings amounting to Rs 130.5m after the year end.

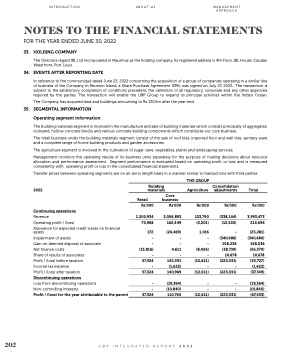

SEGMENTAL INFORMATION

Operating segment information

The building materials segment is involved in the manufacture and sale of building materials which consists principally of aggregates, rocksand, hollow concrete blocks and various concrete building components which constitutes our core business.

The retail business under the building materials segment consist of the sale of roof tiles, imported floor and wall tiles, sanitary ware and a complete range of home building products and garden accessories.

The agriculture segment is involved in the cultivation of sugar cane, vegetables, plants and landscaping services.

Management monitors the operating results of its business units separately for the purpose of making decisions about resource allocation and performance assessment. Segment performance is evaluated based on operating profit or loss and is measured consistently with operating profit or loss in the consolidated financial statements.

Transfer prices between operating segments are on an arm’s length basis in a manner similar to transactions with third parties.

2022

Building materials

Core Retail business

Rs’000 Rs’000

THE GROUP

Agriculture

Rs’000

123,790

(5,201)

1,016 - - (8,426) -

(12,611) -

(12,611)

-

-

(12,611)

Consolidation adjustments

Rs’000

(338,144)

(12,520)

- (340,686) 158,236 (38,739) 10,678

(223,031) -

(223,031)

-

-

(223,031)

Total

Rs’000

3,993,473

215,696

(23,281) (340,686) 158,236 (56,370) 10,678

(35,727) (1,622)

(37,349)

(19,364)

(10,840)

(67,553)

Continuing operations

Revenue 1,200,934 3,006,893

Operating profit / (loss) 70,968 162,449

Allowance for expected credit losses on financial

assets 172 (24,469)

Impairment of assets

Gain on deemed disposal of associate

Net finance costs

Share of results of associates

Profit / (loss) before taxation

Income tax expense

Profit / (loss) after taxation

Discontinuing operations

Loss from discontinuing operations

Non-controlling interests

Profit / (loss) for the year attributable to the parent

- -

- - (13,816) 4,611 - -

57,324 142,591 - (1,622)

57,324 140,969

- (19,364)

- (10,840)

57,324 110,765

202

UBP INTEGRATED REPORT 2022