Page 203 - flipbook-ubp-IR

P. 203

OUR CORPORATE PERFORMANCE GOVERNANCE

Terms and conditions of transactions with related parties:

The sales to and purchases from related parties are made at normal market prices. Outstanding balances at the year end are unsecured, interest free and settlement occurs in cash. There have been no guarantees provided or received for any related party receivables and payables. At each financial year, an assessment of provision for impairment is undertaken through examining the financial position of the related party and the market in which the related party operates. For the year ended June 30, 2022, the Group has no impairment of receivables relating to amounts owed by related parties (2021: Rs Nil). The Company has recorded an impairment of Rs 211.4m during the year ended June 30, 2022 (2021: Rs 52.3m) relating to related parties. This assessment is undertaken each financial year through examining the financial position of the related party and the market in which the related party operates.

30. CONTRACTS OF SIGNIFICANCE

Except for transactions as disclosed in note 29 on related party transactions, the Group did not have any contract of significance as defined by the Listing Rules of the Stock Exchange of Mauritius Ltd with any of its Directors and controlling shareholders.

31. CAPITAL COMMITMENTS

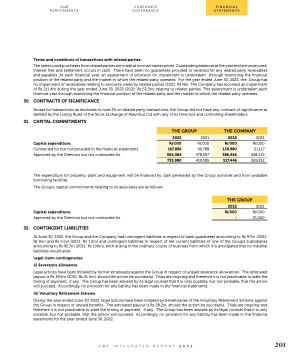

Capital expenditure:

Contracted for but not provided in the financial statements Approved by the Directors but not contracted for

2021 Rs’000 21,117 248,215 269,332

THE GROUP

2022

167,896

566,084

733,980

2021

Rs’000

40,788 378,597

419,385

2022

Rs’000

Rs’000

130,980

386,466

517,446

The expenditure for property, plant and equipment will be financed by cash generated by the Group activities and from available borrowing facilities.

The Group’s capital commitments relating to its associates are as follows:

Capital expenditure:

Approved by the Directors but not contracted for

32. CONTINGENT LIABILITIES

2021 Rs’000 21,060

THE GROUP

2022

Rs’000

-

At June 30, 2022, the Group and the Company had contingent liabilities in respect of bank guarantees amounting to Rs 9.7m (2021: Rs 9m) and Rs 5.5m (2021: Rs 1.2m) and contingent liabilities in respect of net current liabilities of one of the Group’s subsidiaries amounting to Rs 92.7m (2021: Rs 106m), both arising in the ordinary course of business from which it is anticipated that no material liabilities would arise.

Legal claim contingencies:

(i) Severance allowance

Legal actions have been initiated by former employees against the Group in respect of unpaid severance allowances. The estimated payout is Rs 39.5m (2021: Rs 41.5m), should the action be successful. Trials are ongoing and therefore it is not practicable to state the timing of payment, if any. The Group has been advised by its legal counsel that it is only possible, but not probable, that the action will succeed. Accordingly, no provision for any liability has been made in the financial statements.

(ii) Voluntary Retirement Scheme

During the year ended June 30, 2022, legal actions have been initiated by beneficiaries of the Voluntary Retirement Scheme against the Group in respect of unpaid benefits. The estimated payout is Rs 28.2m, should the action be successful. Trials are ongoing and therefore it is not practicable to state the timing of payment, if any. The Group has been advised by its legal counsel that it is only possible, but not probable, that the action will succeed. Accordingly, no provision for any liability has been made in the financial statements for the year ended June 30, 2022.

UBP INTEGRATED REPORT 2022 201

THE COMPANY

FINANCIAL STATEMENTS