Page 176 - flipbook-ubp-IR

P. 176

INTRODUCTION ABOUT US MANAGEMENT APPROACH

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2022

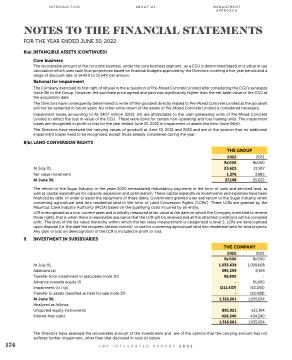

8(a).INTANGIBLE ASSETS (CONTINUED)

Core business

The recoverable amount of the concrete business, under the core business segment, as a CGU is determined based on a value in use calculation which uses cash flow projections based on financial budgets approved by the Directors covering a five year period and a range of discount rate of 14.45% to 15.54% per annum.

Rational for impairment

The Company exercised its first right of refusal in the acquisition of Pre-Mixed Concrete Limited after considering the CGU’s synergies (note 36) to the Group. However, the purchase price agreed and paid was significantly higher than the net asset value of the CGU at the acquisition date.

The Directors have consequently determined to write off the goodwill directly related to Pre-Mixed Concrete Limited as the goodwill will not be sustained in future years. No other write-down of the assets of Pre-Mixed Concrete Limited is considered necessary.

Impairment losses amounting to Rs 340.7 million (2021: nil) are attributable to the cash generating units of Pre-Mixed Concrete Limited to reflect the loss in value of the CGU. These were done for certain non-operating and loss making units. The impairment losses are recognised in profit or loss for the year ended June 30, 2022 in impairment of assets line item (note 24(e)).

The Directors have reviewed the carrying values of goodwill at June 30, 2021 and 2022 and are of the opinion that no additional impairment losses need to be recognised, except those already considered during the year.

8(b).LAND CONVERSION RIGHTS

THE GROUP

2022

At July 01,

Fair value movement At June 30,

2021 Rs’000 21,937 3,685 25,622

Rs’000

9.

INVESTMENT IN SUBSIDIARIES

At July 01,

Additions (a)

Transfer from investment in associates (note 10) Advance towards equity (f)

Impairment (c) / (g)

Transfer to assets classified as held for sale (note 37) At June 30,

Analysed as follows:

Unquoted equity instruments

Interest free loans

The reform of the Sugar Industry in the years 2000 necessitated redundancy payments in the form of cash and serviced land, as well as capital expenditure for capacity expansion and optimisation. These capital expenditure investments and expenses have been financed by debt. In order to assist the repayment of these debts, Government granted a tax exemption to the Sugar Industry when converting agricultural land into residential land in the form of Land Conversion Rights (“LCRs”). These LCRs are granted by the Mauritius Cane Industry Authority (MCIA) based on the qualifying costs incurred by an entity.

LCR is recognised as a non-current asset and is initially measured at fair value at the date on which the Company is entitled to receive those rights, that is when there is reasonable assurance that the LCR will be received and all the attached conditions will be complied with. The level of the fair value hierarchy within which the fair value measurement is categorised is level 2. LCRs are derecognised upon disposal (i.e. the date the recipient obtains control), or use for converting agricultural land into residential land for land projects. Any gain or loss on derecognition of the LCR is included in profit or loss.

2021 Rs’000 1,009,608 9,109 - 91,600 (52,255) (22,428) 1,035,634

611,394 424,240 1,035,634

174

UBP INTEGRATED REPORT 2022

The Directors have assessed the recoverable amount of the investments and are of the opinion that the carrying amount has not suffered further impairment, other than that disclosed in note (c) below.

25,622

1,576

27,198

THE COMPANY

2022

Rs’000

1,035,634

395,259

96,805

(211,437)

-

-

1,316,261

892,021

424,240

1,316,261