Page 175 - flipbook-ubp-IR

P. 175

OUR CORPORATE PERFORMANCE GOVERNANCE

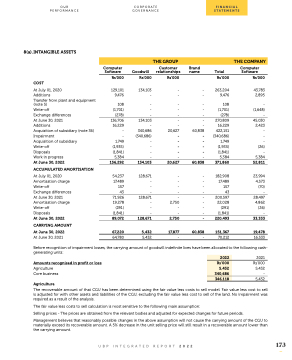

8(a).INTANGIBLE ASSETS

COST

At July 01, 2020

Additions 9,476

Transfer from plant and equipment

(note 5) 108

Write-off (1,701) Exchange differences (278)

At June 30, 2021 136,706 Additions 16,229 Acquisition of subsidiary (note 36) - Impairment - Acquisition of subsidiary 1,749 Write-off (1,935) Disposals (1,841)

THE GROUP

THE COMPANY

Computer Software

Rs’000

Customer Goodwill relationships

Rs’000 Rs’000

134,103 - - -

- - - - - -

134,103 - - - 340,686 20,627 (340,686) - - - - - - - - -

134,103 20,627

128,671 - - - - - - -

128,671 - - 2,750 - - - -

128,671 2,750

5,432 17,877

5,432 -

Brand name

- -

- - -

-

- 60,838 - - - - -

60,838

- - - -

- - - -

-

60,838

-

Total

Rs’000

263,204 9,476

108 (1,701) (278) 270,809 16,229 422,151 (340,686) 1,749 (1,935) (1,841) 5,384

371,860

182,908 17,489 157 43

200,597 22,028 (291) (1,841)

220,493

151,367

70,212

Computer Software

Rs’000

43,783 2,895

- (1,648) - 45,030 2,423 - - - (26) - 5,384

52,811

23,994 4,573 (70) -

28,497 4,862 (26) -

33,333

19,478

16,533

129,101

Work in progress

At June 30, 2022

ACCUMULATED AMORTISATION

At July 01, 2020

Amortisation charge

Write-off 157

5,384

156,292

Exchange differences

At June 30, 2021

Amortisation charge

Write-off (291) Disposals (1,841)

54,237 17,489

43

89,072

67,220

64,780

71,926 19,278

At June 30, 2022

CARRYING AMOUNT

At June 30, 2022

At June 30, 2021

Before recognition of impairment losses, the carrying amount of goodwill indefinite lives have been allocated to the following cash- generating units:

2022

Rs’000

5,432

340,686

346,118

Amounts recognised in profit or loss

Agriculture Core business

Agriculture

2021

Rs’000 5,432 - 5,432

The recoverable amount of that CGU has been determined using the fair value less costs to sell model. Fair value less cost to sell is adjusted for with other assets and liabilities of the CGU, excluding the fair value less cost to sell of the land. No impairment was required as a result of the analysis.

The fair value less costs to sell calculation is most sensitive to the following main assumption:

Selling prices - The prices are obtained from the relevant bodies and adjusted for expected changes for future periods.

Management believes that reasonably possible changes in the above assumption will not cause the carrying amount of the CGU to materially exceed its recoverable amount. A 5% decrease in the unit selling price will still result in a recoverable amount lower than the carrying amount.

UBP INTEGRATED REPORT 2022 173

FINANCIAL STATEMENTS