Page 174 - flipbook-ubp-IR

P. 174

INTRODUCTION ABOUT US MANAGEMENT APPROACH

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2022

7.

INVESTMENT PROPERTIES

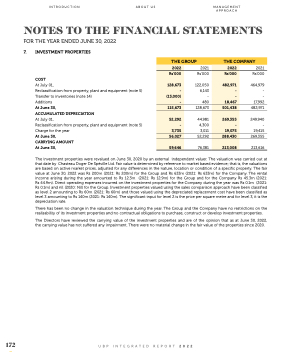

COST

At July 01,

Reclassification from property, plant and equipment (note 5) Transfer to inventories (note 14)

Additions

At June 30,

ACCUMULATED DEPRECIATION

At July 01,

Reclassification from property, plant and equipment (note 5) Charge for the year

At June 30,

CARRYING AMOUNT

At June 30,

THE GROUP

2022

128,673

(13,000)

115,673

52,292

3,735

-

-

-

2021

Rs’000

122,050 6,143 - 480

128,673

44,981 4,300 3,011

THE COMPANY

2022

Rs’000

Rs’000

482,971

18,467

501,438

-

-

269,355

19,075

-

56,027

59,646

52,292

76,381

288,430

213,008

2021 Rs’000

464,979 - - 17,992 482,971

249,940 - 19,415 269,355

213,616

172

UBP INTEGRATED REPORT 2022

The investment properties were revalued on June 30, 2020 by an external independent valuer. The valuation was carried out at that date by Chasteau Doger De Spéville Ltd. Fair value is determined by reference to market based evidence; that is, the valuations are based on active market prices, adjusted for any differences in the nature, location or condition of a specific property. The fair value at June 30, 2022 was Rs 200m (2021: Rs 200m) for the Group and Rs 633m (2021: Rs 633m) for the Company. The rental income arising during the year amounted to Rs 12.3m (2021: Rs 12.9m) for the Group and for the Company Rs 45.3m (2021: Rs 44.9m). Direct operating expenses incurred on the investment properties for the Company during the year was Rs 0.1m (2021: Rs 0.1m) and nil (2020: Nil) for the Group. Investment properties valued using the sales comparison approach have been classified as level 2 amounting to Rs 60m (2021: Rs 60m) and those valued using the depreciated replacement cost have been classified as level 3 amounting to Rs 140m (2021: Rs 140m). The significant input for level 2 is the price per square metre and for level 3, it is the depreciation rate.

There has been no change in the valuation technique during the year. The Group and the Company have no restrictions on the realisability of its investment properties and no contractual obligations to purchase, construct or develop investment properties.

The Directors have reviewed the carrying value of the investment properties and are of the opinion that as at June 30, 2022, the carrying value has not suffered any impairment. There were no material change in the fair value of the properties since 2020.