Page 207 - flipbook-ubp-IR

P. 207

OUR CORPORATE PERFORMANCE GOVERNANCE

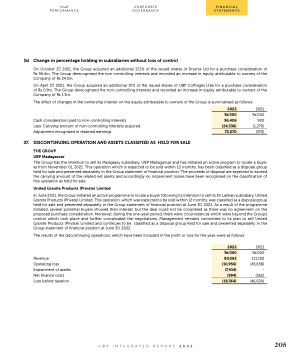

(b) Change in percentage holding in subsidiaries without loss of control

On October 27, 2021, the Group acquired an additional 17.2% of the issued shares of Drymix Ltd for a purchase consideration of Rs 96.4m. The Group derecognised the non-controlling interests and recorded an increase in equity attributable to owners of the Company of Rs 24.3m.

On April 27, 2021, the Group acquired an additional 10% of the issued shares of UBP Coffrages Ltée for a purchase consideration of Rs 0.9m. The Group derecognised the non-controlling interests and recorded an increase in equity attributable to owners of the Company of Rs 1.3m.

The effect of changes in the ownership interest on the equity attributable to owners of the Group is summarised as follows:

2022

Rs’000

96,406

(24,336)

72,070

Cash consideration paid to non-controlling interests

Less: Carrying amount of non-controlling interests acquired Adjustment recognised in retained earnings

37. DISCONTINUING OPERATION AND ASSETS CLASSIFIED AS HELD FOR SALE

THE GROUP

UBP Madagascar

2021 Rs’000 900 (1,270) (370)

The Group has the intention to sell its Malagassy subsidiary, UBP Madagascar and has initiated an active program to locate a buyer as from November 01, 2021. This operation which is expected to be sold within 12 months, has been classified as a disposal group held for sale and presented separately in the Group statement of financial position. The proceeds of disposal are expected to exceed the carrying amount of the related net assets and accordingly no impairment losses have been recognised on the classification of this operation as held for sale.

United Granite Products (Private) Limited

In June 2021, the Group initiated an active programme to locate a buyer following its intention to sell its Sri Lankan subsidiary, United Granite Products (Private) Limited. This operation, which was expected to be sold within 12 months, was classified as a disposal group held for sale and presented separately in the Group statement of financial position at June 30, 2021. As a result of the programme initiated, several potential buyers showed their interest, but the deal could not be completed as there was no agreement on the proposed purchase consideration. Moreover, during the one-year period, there were circumstances which were beyond the Group’s control which took place and further complicated the negotiations. Management remains committed to its plan to sell United Granite Products (Private) Limited and continues to be classified as a disposal group held for sale and presented separately in the Group statement of financial position at June 30, 2022.

The results of the discontinuing operations, which have been included in the profit or loss for the year, were as follows:

Revenue

Operating loss Impairment of assets Net finance costs Loss before taxation

2021 Rs’000 111,102 (45,658) - (362) (46,020)

2022

Rs’000

80,062

(10,956)

(7,414)

(994)

(19,364)

UBP INTEGRATED REPORT 2022

205

FINANCIAL STATEMENTS