Page 171 - flipbook-ubp-IR

P. 171

OUR CORPORATE PERFORMANCE GOVERNANCE

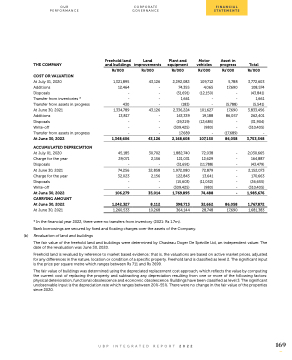

Freehold land THE COMPANY and buildings

Rs’000

COST OR VALUATION

At July 01, 2020 1,321,895 Additions 12,464 Disposals -

Land improvements

Rs’000

43,126 - - - -

43,126 - - - -

43,126

30,702 2,156 -

32,858 2,156 - -

35,014

8,112

10,268

Plant and equipment

Rs’000

2,292,082 74,355 (31,691) 1,661 (183)

2,336,224 143,339 (19,219) (309,425) 17,689

2,168,608

1,882,740 121,031 (31,691)

1,972,080 122,843 (15,603)

(309,425)

1,769,895

398,713

364,144

Motor vehicles

Rs’000

109,712 4,065 (12,150) - -

101,627 19,188 (12,685) (980) -

107,150

72,038

12,629 (11,788)

72,879

13,641 (11,052) (980)

74,488

32,662

28,748

Asset in progress

Rs’000

5,788 17,690 - - (5,788)

17,690 86,057 - - (17,689)

86,058

- - -

- - - -

-

86,058

17,690

Total

Rs’000

3,772,603 108,574 (43,841)

1,661 (5,541)

3,833,456 262,401 (31,904)

(310,405) -

3,753,548

2,030,665 164,887 (43,479)

2,152,073 170,663 (26,655) (310,405)

1,985,676

1,767,872

1,681,383

Transfer from inventories *

Transfer from assets in progress

At June 30, 2021

Additions 13,817 Disposals - Write-off -

- 430

Transfer from assets in progress

At June 30, 2022

ACCUMULATED DEPRECIATION

At July 01, 2020

Charge for the year

Disposals -

At June 30, 2021 74,256 Charge for the year 32,023 Disposals - Write-off -

1,334,789

-

1,348,606

45,185 29,071

At June 30, 2022 CARRYING AMOUNT At June 30, 2022

At June 30, 2021

106,279

1,242,327

1,260,533

* In the financial year 2022, there were no transfers from inventory (2021: Rs 1.7m).

Bank borrowings are secured by fixed and floating charges over the assets of the Company. (b) Revaluation of land and buildings

The fair value of the freehold land and buildings were determined by Chasteau Doger De Spéville Ltd, an independent valuer. The date of the revaluation was June 30, 2020.

Freehold land is revalued by reference to market based evidence; that is, the valuations are based on active market prices, adjusted for any differences in the nature, location or condition of a specific property. Freehold land is classified as level 2. The significant input is the price per square metre which ranges between Rs 711 and Rs 7,699.

The fair value of buildings was determined using the depreciated replacement cost approach, which reflects the value by computing the current cost of replacing the property and subtracting any depreciation resulting from one or more of the following factors: physical deterioration, functional obsolescence and economic obsolescence. Buildings have been classified as level 3. The significant unobservable input is the depreciation rate which ranges between 20%-55%. There were no change in the fair value of the properties since 2020.

UBP INTEGRATED REPORT 2022 169

FINANCIAL STATEMENTS