Page 169 - flipbook-ubp-IR

P. 169

OUR CORPORATE PERFORMANCE GOVERNANCE

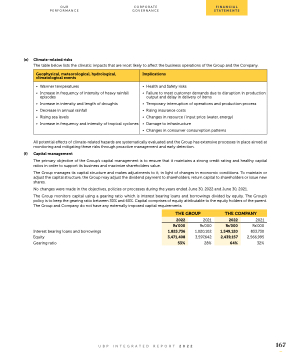

(e) Climate-related risks

The table below lists the climatic impacts that are most likely to affect the business operations of the Group and the Company.

Geophysical, meteorological, hydrological, climatological events

Implications

• Warmer temperatures

• Increase in frequency of intensity of heavy rainfall episodes

• Increase in intensity and length of droughts

• Decrease in annual rainfall

• Rising sea levels

• Increase in frequency and intensity of tropical cyclones

• Health and Safety risks

• Failure to meet customer demands due to disruption in production output and delay in delivery of items

• Temporary interruption of operations and production process • Rising insurance costs

• Changes in resource / input price (water, energy)

• Damage to infrastructure

• Changes in consumer consumption patterns

All potential effects of climate-related hazards are systematically evaluated and the Group has extensive processes in place aimed at monitoring and mitigating these risks through proactive management and early detection.

(f) Capital management

The primary objective of the Group’s capital management is to ensure that it maintains a strong credit rating and healthy capital ratios in order to support its business and maximize shareholders value.

The Group manages its capital structure and makes adjustments to it, in light of changes in economic conditions. To maintain or adjust the capital structure, the Group may adjust the dividend payment to shareholders, return capital to shareholders or issue new shares.

No changes were made in the objectives, policies or processes during the years ended June 30, 2022 and June 30, 2021.

The Group monitors capital using a gearing ratio which is interest bearing loans and borrowings divided by equity. The Group’s policy is to keep the gearing ratio between 30% and 60%. Capital comprises of equity attributable to the equity holders of the parent. The Group and Company do not have any externally imposed capital requirements.

THE GROUP

THE COMPANY

Rs’000 Interest bearing loans and borrowings 1,020,102 Equity 3,597,642 Gearing ratio 28%

2021 Rs’000 833,730 2,566,995 32%

UBP INTEGRATED REPORT 2022

167

2022

1,825,736

3,471,408

53%

2021

2022

Rs’000

Rs’000

1,549,120

2,439,157

64%

FINANCIAL STATEMENTS