Page 166 - flipbook-ubp-IR

P. 166

INTRODUCTION ABOUT US MANAGEMENT APPROACH

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2022

4.

(a) (ii)

FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONTINUED)

Market risk (Continued) Currency profile (Continued)

Foreign currency risk (Continued)

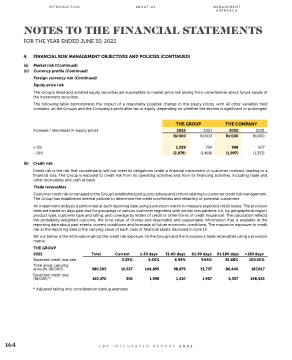

Equity price risk

The Group’s listed and unlisted equity securities are susceptible to market price risk arising from uncertainties about future values of the investment securities.

The following table demonstrates the impact of a reasonably possible change in the equity prices, with all other variables held constant, on the Group’s and the Company’s profit after tax or equity, depending on whether the decline is significant or prolonged.

(b)

Increase / (decrease) in equity prices

+ 5% - 10%

Credit risk

2021 Rs’000 Rs’000

734 677 (1,468) (1,353)

Credit risk is the risk that counterparty will not meet its obligations under a financial instrument or customer contract, leading to a financial loss. The Group is exposed to credit risk from its operating activities and from its financing activities, including trade and other receivables and cash at bank.

Trade receivables

Customer credit risk is managed to the Group’s established policy, procedures and control relating to customer credit risk management. The Group has established internal policies to determine the credit worthiness and reliability of potential customers.

An impairment analysis is performed at each reporting date using a provision matrix to measure expected credit losses. The provision rates are based on days past due for groupings of various customer segments with similar loss patterns (i.e., by geographical region, product type, customer type and rating, and coverage by letters of credit or other forms of credit insurance). The calculation reflects the probability-weighted outcome, the time value of money and reasonable and supportable information that is available at the reporting date about past events, current conditions and forecasts of future economic conditions. The maximum exposure to credit risk at the reporting date is the carrying value of each class of financial assets disclosed in note 15.

Set out below is the information about the credit risk exposure on the Group’s and the Company’s trade receivables using a provision matrix:

THE GROUP

2022

Expected credit loss rate

Total gross carrying amount (Rs’000)

Expected credit loss (Rs’000) *

Total

580,305 160,470

Current

3.29% 10,537 306

1-30 days

31-60 days

61-90 days

9.64% 51,737 1,967

91-180 days

32.68% 86,440 6,357

>180 days

100.00% 187,817 148,432

164

UBP INTEGRATED REPORT 2022

* Adjusted taking into consideration bank guarantees

4.40% 6.94% 144,895 98,879 1,998 1,410

THE GROUP

2022

2021

THE COMPANY

2022

Rs’000

1,039

(2,079)

Rs’000

998

(1,997)