Page 165 - flipbook-ubp-IR

P. 165

OUR CORPORATE PERFORMANCE GOVERNANCE

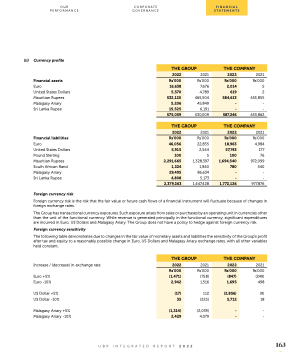

(ii) Currency profile

2021 Financial assets Rs’000 Euro 5 United States Dollars 2 Mauritian Rupees 455,855 Malagasy Ariary - Sri Lanka Rupee - 455,862

2021 Financial liabilities Rs’000 Euro 4,984 United States Dollars 177 Pound Sterling 76 Mauritian Rupees 972,099 South African Rand 540 Malagasy Ariary - Sri Lanka Rupee - 977,876

Foreign currency risk

Foreign currency risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in foreign exchange rates.

The Group has transactional currency exposures. Such exposure arises from sales or purchases by an operating unit in currencies other than the unit of the functional currency. While revenue is generated principally in the functional currency, significant expenditures are incurred in Euro, US Dollars and Malagasy Ariary. The Group does not have a policy to hedge against foreign currency risk.

Foreign currency sensitivity

The following table demonstrates due to changes in the fair value of monetary assets and liabilities the sensitivity of the Group’s profit after tax and equity to a reasonably possible change in Euro, US Dollars and Malagasy Ariary exchange rates, with all other variables held constant.

THE GROUP

2022

Rs’000

16,638

5,570

532,120

5,206

15,525

2021

Rs’000 7,676 4,789 465,504 45,849 6,191

THE COMPANY

2022

Rs’000

2,014

584,613

619

-

-

575,059

530,009

587,246

THE GROUP

2022

1,224

29,495

4,808

2021

THE COMPANY

2022

Rs’000

46,056

5,915

2,291,665

100

Rs’000 22,835 2,544 5 1,328,397 1,840 86,634 5,173

Rs’000

18,963

57,743

1,694,540

100

780

-

-

2,379,263

1,447,428

1,772,126

Increase / (decrease) in exchange rate

Euro +5% Euro -10%

US Dollar +5% US Dollar -10%

Malagasy Ariary +5% Malagasy Ariary -10%

Rs’000 (758) 1,516

112 (225)

(2,039) 4,079

2021 Rs’000 (249) 498

(9) 18

- -

2022

UBP INTEGRATED REPORT 2022

163

THE GROUP

2,942

(17)

(1,214)

2,429

35

2021

THE COMPANY

2022

Rs’000

(1,471)

Rs’000

(847)

1,695

(2,856)

5,712

-

-

FINANCIAL STATEMENTS