Page 142 - flipbook-ubp-IR

P. 142

INTRODUCTION ABOUT US

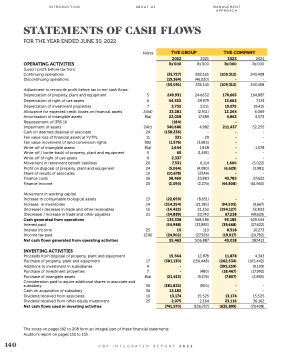

STATEMENTS OF CASH FLOWS

MANAGEMENT APPROACH

FOR THE YEAR ENDED JUNE 30, 2022

OPERATING ACTIVITIES

(Loss) / profit before tax from: Continuing operations Discontinuing operations

Adjustment to reconcile profit before tax to net cash flows: Depreciation of property, plant and equipment Depreciation of right of use assets

Depreciation of investment properties

Allowance for expected credit losses on financial assets Amortisation of intangible assets

Reassessment of IFRS 16

Impairment of assets

Gain on deemed disposal of associate

Fair value loss of financial assets at FVTPL

Fair value movement of land conversion rights

Write-off of intangible assets

Write-off / (write-back) of property, plant and equipment Write-off of right of use assets

Movement in retirement benefit liabilities

Profit on disposal of property, plant and equipment Share of results of associates

Finance costs

Finance income

Movement in working capital

Increase in consumable biological assets

Increase in inventories

(Increase) / decrease in trade and other receivables (Decrease) / increase in trade and other payables Cash generated from operations

Interest paid

Interest income

Income tax paid

Net cash flows generated from operating activities

INVESTING ACTIVITIES

Proceeds from disposal of property, plant and equipment Purchase of property, plant and equipment

Additions to investment in subsidiaries

Purchase of investment properties

Purchase of intangible assets

Notes

5

6

7 24(d) 8(a)

24(c) 24 11 8(b) 8(a) 5

6 20 24 10 26 25

13 14 15 21

25 12(b)

17 9 7 8(a)

2021 Rs’000

243,408 - 243,408

164,887 7,174 19,415 6,069 4,573 - 52,255 - - - 1,578 - - (5,022) (3,981) - 27,622 (61,960)

- (9,667) 32,822 (49,629) 429,544 (27,622) 10,273 (24,782) 387,413

4,343 (105,442) (9,109) (17,992) (2,895)

-

- 15,525 36,162 (79,408)

THE GROUP

2022

Rs’000

(35,727)

(19,364)

249,931

44,552

3,735

23,281

22,028

(184)

340,686

(158,236)

(2,090)

(22,659)

(314,354)

(14,422)

(34,889)

331

(1,576)

1,644

2,337

7,531

(5,064)

(10,678)

58,460

65

2021

236,145

244,632 29,979

3,011 (2,911) 17,489 - 4,982 - 29 (3,685) 1,858 (1,493) - 6,114 (4,080) (7,249) 33,883 (2,274)

(8,651) (21,185) 21,252 20,740

THE COMPANY

2022

Rs’000

282,165 (46,020)

Rs’000

(109,312)

(109,312)

170,663

13,662

19,075

12,244

4,862

211,437

1,600

(6,629)

43,785

(44,808)

(94,505)

(194,127)

67,238

-

(55,091)

-

-

-

-

-

-

-

-

-

135,338

(54,988)

(24,902)

15

568,586 (33,883) 110 (27,926)

95,185

(39,668)

8,518

(19,017)

55,463

506,887

15,564

(381,130)

(21,613)

(381,822)

12,182

13,174

2,075

-

-

12,878 (156,448) - (480) (9,476)

(900) - 15,525 2,164

45,018

11,878

(262,534)

(395,259)

(18,467)

(7,807)

13,174

23,116

-

-

(741,570)

(136,737)

(635,899)

Consideration paid to aquire additional shares in associate and subsidiary 36

Cash on acquisition of subsidiary

Dividend received from associates

Dividend received from other equity investment Net cash flows used in investing activities

36 10 25

140

UBP INTEGRATED REPORT 2022

The notes on pages 142 to 208 form an integral part of these financial statements. Auditor’s report on pages 132 to 135.