Page 140 - flipbook-ubp-IR

P. 140

INTRODUCTION ABOUT US MANAGEMENT APPROACH

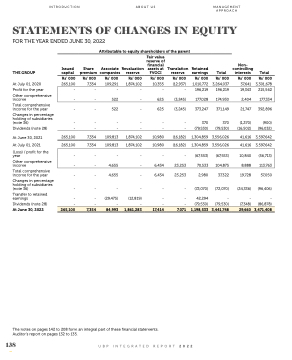

STATEMENTS OF CHANGES IN EQUITY

FOR THE YEAR ENDED JUNE 30, 2022

Attributable to equity shareholders of the parent

THE GROUP

At July 01, 2020 Profit for the year

Other comprehensive income

Total comprehensive income for the year

Changes in percentage holding of subsidiaries (note 36)

Dividends (note 28)

At June 30, 2021 At July 01, 2021

(Loss) / profit for the year

Other comprehensive income

Total comprehensive income for the year

Changes in percentage holding of subsidiaries (note 36)

Transfer to retained earnings

Dividends (note 28)

At June 30, 2022

Issued capital

Rs’ 000

265,100

- -

-

- -

265,100

265,100

- -

-

-

- -

Share premium

Rs’ 000

7,354

- -

-

- -

7,354

7,354

- -

-

-

- -

Associate companies

Rs’ 000

109,291

- 522

522

- -

109,813

109,813

- 4,655

4,655

Revaluation reserve

Rs’ 000

1,874,102

- -

-

- -

1,874,102

1,874,102

- -

-

Fair value reserve of financial assets at FVOCI

Rs’ 000

10,355

- 625

625

- -

10,980

10,980

Translation reserve

Rs’ 000

(12,937)

- (3,245)

(3,245)

- -

(16,182)

(16,182)

Retained earnings

Rs’ 000

1,010,772

196,219 177,028

373,247

370 (79,530)

1,304,859

1,304,859

(67,553) 70,533

2,980

(72,070)

42,294 (79,530)

Total

Rs’ 000

3,264,037

196,219 174,930

371,149

370 (79,530)

3,556,026

3,556,026

(67,553) 104,875

37,322

(72,070)

- (79,530)

Non- controlling interests

Rs’ 000

37,641

19,343 2,404

21,747

(1,270) (16,502)

41,616

41,616

10,840 8,888

19,728

(24,336)

- (7,348)

Total

Rs' 000

3,301,678

215,562 177,334

392,896

(900) (96,032)

3,597,642

3,597,642

(56,713) 113,763

57,050

(96,406)

- (86,878)

- -

(29,475) (12,819) - -

- - 6,434 23,253

6,434 23,253

- -

- - - -

265,100

7,354

84,993

1,861,283

17,414

7,071

1,198,533

3,441,748

29,660

3,471,408

The notes on pages 142 to 208 form an integral part of these financial statements. Auditor’s report on pages 132 to 135.

138 UBP INTEGRATED REPORT 2022