Page 179 - flipbook-ubp-IR

P. 179

OUR CORPORATE PERFORMANCE GOVERNANCE

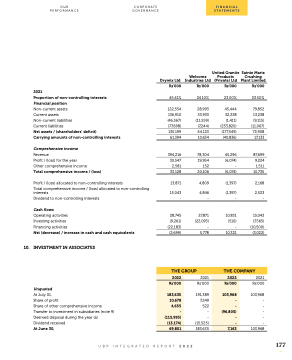

2021

Proportion of non-controlling interests Financial position

Non-current assets

Current assets

Non-current liabilities

Current liabilities

Net assets / (shareholders’ deficit)

Carrying amounts of non-controlling interests

Comprehensive income

Drymix Ltd

Rs’000

45.41%

122,554 136,910 (46,567) (77,698)

135,199

61,394

Welcome Industries Ltd

Rs’000

24.10%

28,993

33,933 (11,559) (7,244)

44,123

10,634

78,304

19,954 152

20,106

4,809

4,846 -

27,871 (22,093) -

5,778

United Granite Products (Private) Ltd

Rs’000

23.00%

45,444 32,238 (1,411) (253,820)

(177,549)

(40,836)

45,296

(6,074) -

(6,074)

(1,397)

(1,397) -

10,831 (510) -

10,321

Sainte Marie Crushing Plant Limited

Rs’000

23.50%

79,852 13,238 (9,115)

(11,067)

72,908

17,133

87,699

9,224 1,511

10,735

2,168

2,523 -

15,043

(7,565) (10,500)

(3,022)

2021 Rs’000

103,968 - - - - - 103,968

Revenue 394,216

Profit / (loss) for the year

Other comprehensive income

Total comprehensive income / (loss)

30,547 2,581

33,128

Profit / (loss) allocated to non-controlling interests

13,871 interests 15,043

Total comprehensive income / (loss) allocated to non-controlling Dividend to non-controlling interests

Cash flows

Operating activities

Investing activities

Financing activities

Net (decrease) / increase in cash and cash equivalents

10. INVESTMENT IN ASSOCIATES

Unquoted

At July 01,

Share of profit

Share of other comprehensive income Transfer to investment in subsidiaries (note 9) Deemed disposal during the year (a) Dividend received

At June 30,

-

28,745

(9,261) (22,183)

(2,699)

THE GROUP

2022

(115,993)

(13,174)

-

2021

THE COMPANY

2022

Rs’000

183,635

10,678

4,655

Rs’000

191,389 7,249 522 - - (15,525)

Rs’000

103,968

(96,805)

-

-

-

-

69,801

183,635

7,163

UBP INTEGRATED REPORT 2022

177

FINANCIAL STATEMENTS