Page 161 - flipbook-ubp-IR

P. 161

OUR CORPORATE PERFORMANCE GOVERNANCE

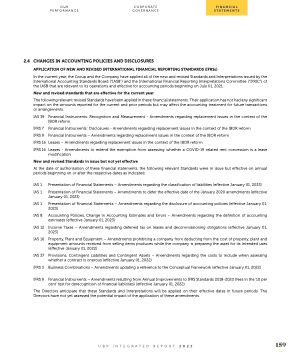

2.4 CHANGES IN ACCOUNTING POLICIES AND DISCLOSURES

APPLICATION OF NEW AND REVISED INTERNATIONAL FINANCIAL REPORTING STANDARDS (IFRSs)

In the current year, the Group and the Company have applied all of the new and revised Standards and Interpretations issued by the International Accounting Standards Board (“IASB”) and the International Financial Reporting Interpretations Committee (“IFRIC”) of the IASB that are relevant to its operations and effective for accounting periods beginning on July 01, 2021.

New and revised standards that are effective for the current year

The following relevant revised Standards have been applied in these financial statements. Their application has not had any significant impact on the amounts reported for the current and prior periods but may affect the accounting treatment for future transactions or arrangements.

IAS 39

IFRS 7 IFRS 9 IFRS 16 IFRS 16

Financial Instruments: Recognition and Measurement - Amendments regarding replacement issues in the context of the IBOR reform

Financial Instruments: Disclosures - Amendments regarding replacement issues in the context of the IBOR reform

Financial Instruments – Amendments regarding replacement issues in the context of the IBOR reform

Leases – Amendments regarding replacement issues in the context of the IBOR reform

Leases - Amendments to extend the exemption from assessing whether a COVID-19 related rent concession is a lease modification

New and revised Standards in issue but not yet effective

At the date of authorisation of these financial statements, the following relevant Standards were in issue but effective on annual periods beginning on or after the respective dates as indicated:

IAS 1 IAS 1

IAS 1 IAS 8 IAS 12 IAS 16

IAS 37

IFRS 3

IFRS 9

Presentation of Financial Statements – Amendments regarding the classification of liabilities (effective January 01, 2023)

Presentation of Financial Statements – Amendments to defer the effective date of the January 2020 amendments (effective January 01, 2023)

Presentation of Financial Statements – Amendments regarding the disclosure of accounting policies (effective January 01, 2023)

Accounting Policies, Change in Accounting Estimates and Errors – Amendments regarding the definition of accounting estimates (effective January 01, 2023)

Income Taxes – Amendments regarding deferred tax on leases and decommissioning obligations (effective January 01, 2023)

Property, Plant and Equipment – Amendments prohibiting a company from deducting from the cost of property, plant and equipment amounts received from selling items produces while the company is preparing the asset for its intended uses (effective January 01, 2022)

Provisions, Contingent Liabilities and Contingent Assets – Amendments regarding the costs to include when assessing whether a contract is onerous (effective January 01, 2022)

Business Combinations – Amendments updating a reference to the Conceptual Framework (effective January 01, 2022)

Financial Instruments – Amendments resulting from Annual Improvements to IFRS Standards 2018-2020 (fees in the ’10 per cent’ test for derecognition of financial liabilities) (effective January 01, 2022)

The Directors anticipate that these Standards and Interpretations will be applied on their effective dates in future periods. The

Directors have not yet assessed the potential impact of the application of these amendments.

UBP INTEGRATED REPORT 2022 159

FINANCIAL STATEMENTS